We are Accepting CDCP

At What a Smile Dental Hygiene Clinic, we’re proud to welcome patients covered under the Canadian Dental Care Plan (CDCP). By participating in the CDCP, we can provide eligible individuals and families with high-quality preventive and therapeutic hygiene services at little or no out-of-pocket cost.

From routine cleanings and periodontal therapy to personalized home-care guidance, every visit is designed to protect your oral health while fitting comfortably within your CDCP benefits. Our friendly team will verify your coverage, explain exactly what’s included, and handle the paperwork on your behalf—so you can focus on enjoying a healthier, brighter smile.

If you’re already enrolled in the CDCP, simply mention it when you book and bring your plan details to your first appointment. Not sure whether you qualify? Call us or book a complimentary eligibility check, and we’ll guide you through the steps. At What a Smile, caring for your smile—and your peace of mind—is what we do best.

CDCP FAQ

FAQ

When will the remaining Canadians be able to apply to the CDCP?

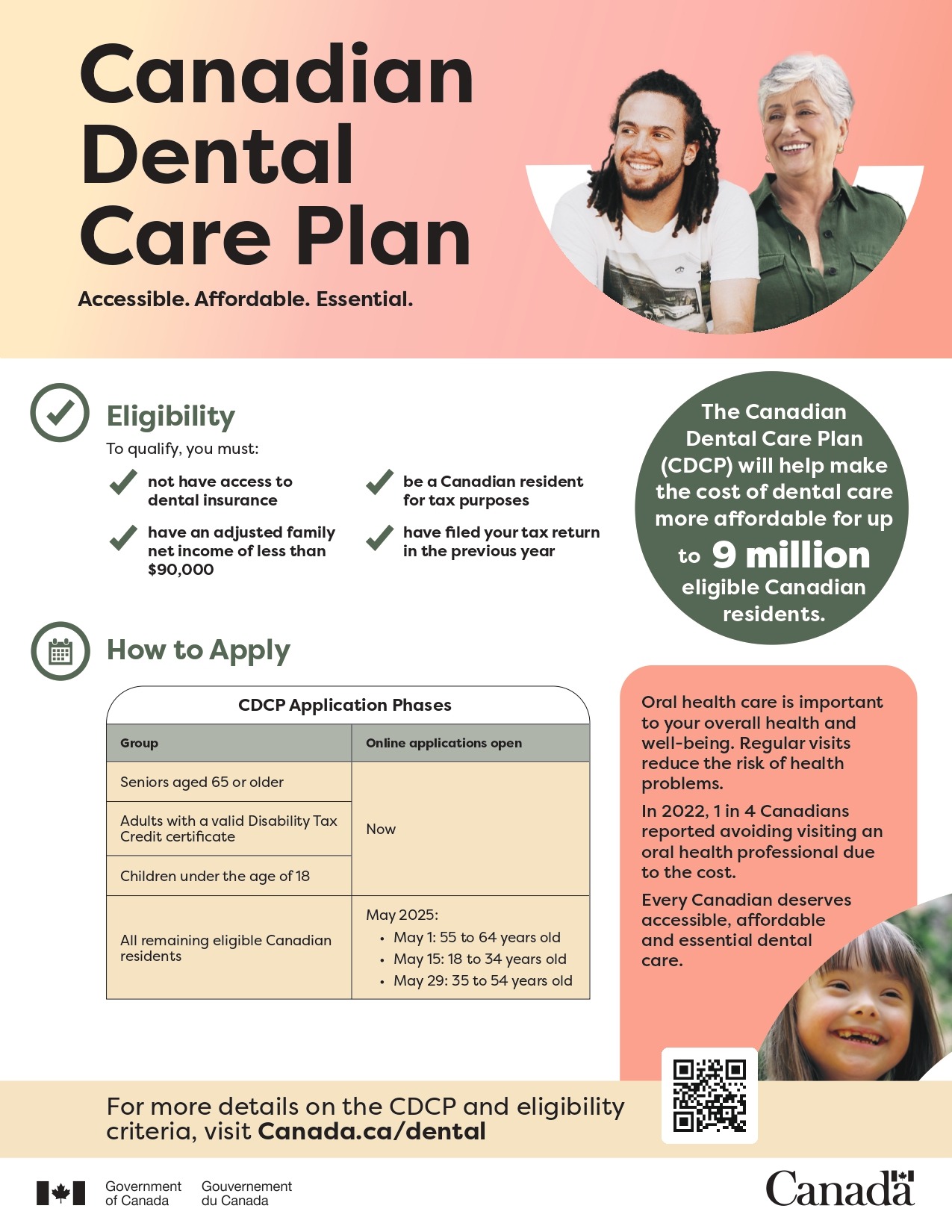

Applications to the Canadian Dental Care Plan (CDCP) are currently open for seniors aged 65 and over, adults with a valid federal disability tax credit certificate for 2023 and children under 18.

In May 2025, the Canadian Dental Care Plan (CDCP) will expand to welcome applications from all remaining eligible Canadians aged 18 to 64 years, with coverage starting as early as June 1, 2025, based on when they apply and are enrolled in the CDCP. Applications will open by age group:

- May 1: 55 to 64 years old

- May 15: 18 to 34 years old

- May 29: 35 to 54 years old

What are the eligibility requirements for the CDCP?

To qualify for the CDCP, the following criteria must be met. Eligibility will be reassessed annually:

- no access to dental insurance;

- an adjusted family net income of less than $90,000;

- be a Canadian resident for tax purposes; and

- have filed tax returns for themself and their spouse/common-law partner (if applicable) in Canada so that their family income can be assessed for the previous year.

Canadian residents who have access to dental benefits through provincial, territorial or federal government social programs, can still qualify for the CDCP. If they meet all the eligibility criteria, their coverage will be coordinated between the plans to ensure there are no duplication or gaps in coverage.

What does not having access to dental insurance mean?

This means a person does not have access to any type of dental insurance or coverage through:

- their employment benefits or a family member’s employment benefits, including health and wellness accounts

- a professional or student organization

Note: If a person is eligible for dental coverage through their employment benefits or through a professional or student organization, they’re not eligible for CDCP. This is true even if:

- they decide not to take it**

- they have to pay a premium for it

- they don’t use it

- their pension benefits or a family member’s pension benefits

- this includes federal, provincial and territorial government employer pension plans

- Exception: They may be eligible for the CDCP if they’re retired and:

- they opted out of pension benefits before December 11, 2023, and

- they can’t opt back in under the pension rules

- coverage purchased by an individual or their family member or through a group plan from an insurance or benefits company

- if they purchased their current dental insurance policy privately (and not as part of any of the coverage described above), they’re not eligible for the CDCP while that coverage is in effect.

**Canadian residents are still considered to have access to dental insurance if they choose to opt out of available benefits like these.

If an individual has access to dental coverage/insurance, whether they use it or not, through anywhere other than a publicly funded social program, they will be ineligible for the CDCP.

If that coverage comes from a plan the individual purchased privately on their own (unrelated to employment, pension, union or other group coverage), while that self-purchased coverage is in effect, they are ineligible for the CDCP.

The Government of Canada has determined the eligibility criteria for the CDCP with the intention of helping as many Canadian residents as possible access needed oral health care while also ensuring the sound stewardship of public funds.

As part of the CDCP application process, potentially eligible applicants will be required to attest that they do not have access to any dental insurance, which will be verified through a sample audit process by Health Canada. This attestation will be further validated using the T4/T4A dental requirement where employers, through the Dental Care Measures Act, are required to report if their employees or pensioners are eligible to access dental insurance.

How is the adjusted family net income calculated?

Based on the Canada Revenue Agency definition and calculation, the adjusted family net income is:

- a person’s family net income (line 23600 of their tax return plus line 23600 of their spouse’s or common-law partner’s tax return, and any world income not reported in a tax return to the CRA, such as by a new resident)

- minus any universal childcare benefit (UCCB) and registered disability savings plan (RDSP) income received (line 11700 and line 12500 of a person’s or their spouse’s or common-law partner’s tax return)

- plus, any UCCB and RDSP amounts repaid (line 21300 and line 23200 of a person’s or their spouse’s or common-law partner’s tax return)

Family net income is a person’s net income plus the net income of their spouse or common-law partner, if they have one. Family net income does not include their child’s net income.

For the vast majority of individuals, adjusted family net income is their and their spouse or common-law partner’s net income.

What happens if one of the family members did not file their taxes?

The CDCP is an income tested program. To confirm a person’s eligibility to the income threshold of less than $90,000, the individual and their spouse or common-law partner, if they have one, must have filed the previous year’s income tax return in Canada.

If someone needs help to get started with filing their taxes, they can go to Canada.ca/cra.

Further, a person can claim dental costs as medical expenses on their tax return, as long as they only claim expenses that have not or will not be reimbursed by the CDCP.

Do I still qualify if I have access to student coverage?

No. If you’re eligible for dental coverage through your own employment benefits, your family’s employment or pension benefits or through a professional or student organization, you’re not eligible for CDCP.

This is true even if:

- you decide not to take it

- you must pay a premium for it

- you don’t use it

What services are covered under the CDCP?

To improve oral health outcomes, the CDCP will cover a wide range of oral health care services, on the recommendation of an oral health care provider.

Examples of services that could be covered under the CDCP include:

- preventive services, including scaling (cleaning), sealants, and fluoride

- diagnostic services, including examinations and x-rays

- restorative services, including fillings

- endodontic services, including root canal treatments

- prosthodontic services, including removable dentures

- periodontal services, including deep scaling

- oral surgery services, including extractions

The CDCP covers a wide range of services, however some oral health services such as crowns, initial placement of partial dentures, and general anesthesia will require preauthorization and started on November 1, 2024. The 2024 CDCP dental benefit grids are available on the Sun Life website: https://www.sunlife.ca/sl/cdcp/en/provider/dental-benefit-grids/.

Preauthorization is a process to request pre-approval for coverage of certain services, including those above frequency limits, that have not been available under the CDCP before now. These requests will not be paid unless the CDCP agrees that the clinical criteria for coverage under the plan, like the medical needs of each person, is met prior to proceeding with treatment.

Oral health providers are invited to consult the updated CDCP Dental Benefits Guide to review the supporting documentation necessary for services that require preauthorization and related policies and guidelines.

How does the frequency limits for services covered under the CDCP work?

People covered under the CDCP who have reached the frequency limits for services covered under the CDCP might be wondering when those services will be covered again. It’s important to understand that those services won’t necessarily be eligible for coverage at the same time as their CDCP benefit coverage period. That’s because the CDCP benefit period is different from the rolling period used to define frequency limits:

- A benefit period is fixed yearly period on when an individual who is eligible under the CDCP will be covered for services under the plan.

- A rolling period is based on the first day a claim is made for a specific service and used when specific services have a frequency limit.

Is there a cost to be part of the CDCP?

The CDCP is not a free plan. To limit the out-of-pocket expenses for people covered under the plan, oral health providers that accepts CDCP patients will be reimbursed directly by Sun Life for the eligible services provided, in accordance with the CDCP established fees, which may not be the same as what providers charge.

The CDCP will reimburse a percentage of the cost, based on established CDCP fees and a person’s adjusted family net income. A patient may have to pay additional charges directly to the oral health provider, if:

- their adjusted family net income is between $70,000 and $89,999, as they will have a co-payment

- the cost of their oral health care services is more than what the CDCP will reimburse based on the established CDCP fees; and

- they or their oral health care provider agree to services that the CDCP doesn’t cover (the patient will need to pay the full cost of these services).

Based on the adjusted family net income threshold, co-payment for services will apply:

- No co-payments for those below $70,000.

- 40% co-payment for those between $70,000 and $79,999.

- 60% co-payment for those between $80,000 and $89,999.

Before receiving oral health care, individuals covered under the plan should always confirm what costs, if any, will not be covered by the CDCP.

Provider appointment cancellation/no-show fees cannot be billed to the CDCP. Therefore, patients will be responsible for covering these fees.

When will a patient be able to see an oral health provider under the CDCP?

Since May 2024, eligible applicants have started receiving care under the CDCP. The start date to access oral health care services depends on:

- when the application is received and

- when the enrolment is completed

The individual’s coverage will begin on the start date provided in the welcome package from Sun Life. Appointments with an oral health provider should be scheduled as of the individual’s coverage start date, and no sooner, in order for the oral health care services to be covered under the plan. The CDCP will not reimburse a patient for oral health care services received

How will the renewal process work?

Since March 2025, Canadians currently covered under the CDCP who have filed their 2024 tax return, and received their Notice of Assessment from the Canada Revenue Agency will be able to renew their coverage. The last day to renew without a potential gap in coverage is June 1, 2025.

Renewal applications can be done online at canada.ca/dental or in My Service Canada Account (MSCA). Applicants can also use the automated Interactive Voice Response (IVR) system to submit their information. To access IVR, applicants should call the CDCP contact centre at 1-833-537-4342 and press 2 to apply and be guided through a series of questions to complete the renewal of their application.

Those who require assistance with the renewal application process can call the CDCP contact centre at 1-833-537-4342 (teletypewriter (TTY) at 1-833-677-6262) or visit a Service Canada Centre.

Why do I have to apply again (renewal)?

Every year, Canadians covered under the CDCP will need to confirm that they continue to meet all eligibility requirements, including:

- Not having access to private dental insurance, whether offered through their own employment or pension, a family member’s employment or pension or through a professional or student organization

- Individuals and their spouse or common-law partner, if applicable, have both filed their tax returns in Canada so that their family income can be assessed

- Have an adjusted family net income less than $90,000

- Be a Canadian resident for tax purposes

It is important that individuals complete their 2024 tax return, as their CDCP renewal application will only be assessed once their 2024 Notice of Assessment is issued by the Canada Revenue Agency. It is important to complete the renewal application before June 1 as any oral health care received during a gap in coverage will not be covered.

What happens if I miss the renewal deadline?

The last day to renew without a gap in coverage is June 1, 2025.

- Clients who do not apply to renew will have their benefits end on June 30, 2025.

- Clients who are eligible but apply to renew after June 1, 2025, will have their benefits reinstated but during this period will face a gap in care (any care received during a gap in coverage will not be covered retroactively).

- Clients who apply to renew but are deemed ineligible for the 2025 benefit year will have their benefits end on June 30, 2025.

As a returning member, will my coverage year always be from June 1st to June 30 of the next year?

No. The differences in the coverage years are only for 2025 to allow for the early onboarding of the 18 to 64 cohort. As an exception, the 2025 coverage year will run from June 1, 2025, (or start date of coverage) to June 30, 2026.

All future CDCP coverage benefit periods will be from July 1 to June 30.

How is the CDCP administered?

The CDCP is administered by Health Canada with the support of Employment and Social Development Canada (ESDC), through Service Canada. Service Canada acts as a service delivery partner for processing applications for the CDCP, drawing on applicant provided information as well as taxpayer information provided by the Canada Revenue Agency (e.g., to assess family income). Service Canada provides qualified applicant information to Sun Life, the contracted service provider, to enrol them in the CDCP and process claims.

What is the Government of Canada doing to prevent private businesses from cancelling their dental plans once the CDCP is fully implemented?

Private businesses should not be cancelling their dental plans. The Government of Canada will continue to work with industry partners and provincial and territorial governments to put in place mitigation solutions that avoid displacement of existing dental plans.

The CDCP is intended to help those who currently have no access to dental insurance, not to replace current employer benefits packages they offer employees as part of their competitive compensation packages. In addition, based on the income threshold and associated co-payment structure under the CDCP, most employees will be better off under their current employer-sponsored plans.

We anticipate that in most cases employer-sponsored insurance will be maintained by private businesses as a means of recruitment and retention of their employees (i.e., competitive compensation package).

If a person is covered under an existing provincial or territorial public dental care program, are they still eligible for the CDCP?

Provincial and territorial programs may not cover all oral health care needs of Canadians equally across the country, and that in some cases, these programs focus only on emergency needs.

Canadian residents who have access to dental coverage through provincial and territorial social programs and meet the CDCP eligibility criteria will be able to apply to the CDCP. Coverage will be coordinated between provincial or territorial public dental care program and the CDCP to ensure there is no duplication and to avoid gaps in oral health care.

To help understand how the CDCP will intersect and/or coordinate with provincial and territorial social dental programs, individual factsheets have been developed, based on guidance provided by each provincial or territorial government: https://www.canada.ca/en/services/benefits/dental/dental-care-plan/providers.html

Can any oral health professional in Canada provide services under the CDCP?

The collaboration between oral health professionals and the Government of Canada is a critical success factor for the CDCP.

Oral health professionals (including Dentists, Dental Specialists, Denturists, or Independent Dental Hygienists) who are licensed and in good standing with the provincial or territorial regulatory body in the jurisdiction in which they practice will be able to participate in the CDCP.

To facilitate access to the CDCP for eligible Canadian residents, there are two ways for oral health providers to participate in the CDCP and provide care to CDCP patients; either by:

- Signing up formally through Sun Life (currently possible).

- Submitting claims directly to Sun Life for payment, on a claim-by-claim basis (started on July 8; note: there will be no retractive payment to providers who provided treatment under this option prior to July 8).

In both options, oral health providers agree to bill Sun Life directly for payment of services covered under the CDCP to limit out-of-pocket costs for CDCP patients.

People covered under the CDCP can use Sun Life’s CDCP Provider Search Tool to find participating providers, or contact oral health providers in their community.

Before receiving any oral health care services, people covered under the CDCP should confirm that their provider is accepting CDCP patients and that the services they will be receiving are eligible for coverage. It’s important that a patient does not pay upfront for the services received. The CDCP only reimburses providers directly, not patients.

If a patient pays the full costs, they will not be reimbursed. They should only pay any potential amounts not covered by the plan directly to their oral health provider.

What fees should be paid directly to an oral health provider?

Oral health providers are asked to confirm their participation in the CDCP to accept receiving direct payment from Sun Life. To limit out-of-pocket costs for Canadians, oral health providers who accept CDCP patients will directly bill Sun Life for eligible services provided.

The CDCP will only pay for oral health care services covered within the plan at the established CDCP fees. CDCP fees may differ from those set out in the provincial and territorial oral health associations suggested fee guides, which providers often use to charge for oral health services.

People covered under the CDCP may have to pay an outstanding amount such as a co-payment or additional charges, which will need to be paid directly to their oral health provider if:

- their adjusted family net income is between $70,000 and $89,999, as they will have a co-payment

- the cost of their oral health care services is more than what the CDCP will be reimbursed based on the established CDCP fees; and

- they agree to receive care that the plan doesn’t cover

Before receiving oral health care, individuals covered under the plan should always ask their oral health provider about any costs, that will not be covered by the plan, and make sure they know what they will have to pay directly to their oral health provider ahead of receiving treatment.

Provider appointment cancellation/no-show fees cannot be billed to the CDCP. Patients will be responsible for covering these fees.

Meet Your Smile Care Team

Our Location

Conveniently located at 23 William Cragg Dr, North York, ON, What a Smile Dental Hygiene Clinic is easily accessible and designed with your comfort in mind.